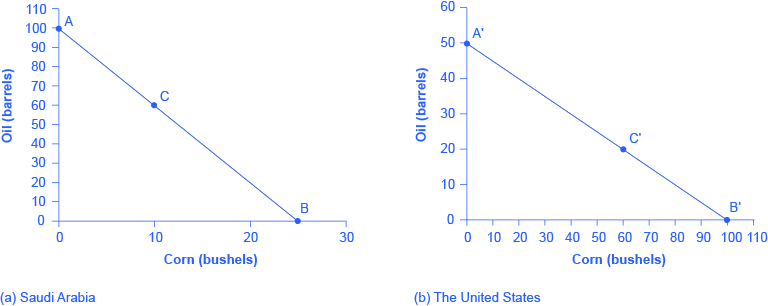

class: center, middle, inverse, title-slide .title[ # Session 3: Nations in the Global Environment ] .author[ ### Th. Warin, PhD ] --- class: inverse, middle # Goals - Developing an understanding of myths and realities about globalization based on data - Developing an agile framework to analyze **global risks** and **global political risks** in particular > Benjamin Franklin (1706–1790) once wrote: “No nation was ever ruined by trade.” --- ## Agenda 1. Comparative advantage of nations 2. Competitive advantage of nations --- class: inverse, center, middle # Introduction --- ### Introduction - Definitions: country or Nation? > See Maurice Duverger. - Definitions: nationalism, patriotism, populism, ... --- ### Introduction Rosenvallon (2020) on populism: - a conception of the people (the One-people); - a theory of democracy (preference for direct democracy, rejection of intermediary bodies and domestication of unelected institutions, spontaneous expression of the general will); - a policy and a philosophy of the economy (national-protectionism in a sovereignist vision attentive to the security of the population); - a regime of passions and emotions (feeling of abandonment, of invisibility, need for a more legible world filled with stories of conspiracy essence, desire to act through eviction) --- class: inverse, center, middle # Hans Rosling > [Hans Rosling Ted talk, 2006](https://www.gapminder.org/videos/hans-rosling-ted-2006-debunking-myths-about-the-third-world/) --- class: inverse, center, middle # 1. Comparative Advantage of Nations --- ## Trade (% of GDP) <div class="container-fluid crosstalk-bscols"> <div class="row"> <div class="col-xs-3"> <div class="container-fluid crosstalk-bscols"> <div class="row"> <div class="col-xs-12"> <div id="country" class="form-group crosstalk-input-select crosstalk-input"> <label class="control-label" for="country">Region</label> <div> <select multiple></select> <script type="application/json" data-for="country">{ "items": { "value": ["World"], "label": ["World"] }, "map": { "World": ["2", "3", "4", "5", "6", "7", "8", "9", "10", "11", "12", "13", "14", "15", "16", "17", "18", "19", "20", "21", "22", "23", "24", "25", "26", "27", "28", "29", "30", "31", "32", "33", "34", "35", "36", "37", "38", "39", "40", "41", "42", "43", "44", "45", "46", "47", "48", "49", "50", "51", "52"] }, "group": ["SharedData1e90ebfd"] }</script> </div> </div> </div> <div class="col-xs-12"> <div class="form-group crosstalk-input crosstalk-input-slider js-range-slider" id="year"> <label class="control-label" for="year">Year</label> <input data-skin="shiny" data-type="double" data-min="1970" data-max="2020" data-from="1970" data-to="2020" data-step="1" data-grid="true" data-grid-num="10" data-grid-snap="false" data-prettify-separator="" data-keyboard="true" data-keyboard-step="2" data-drag-interval="true" data-data-type="number"/> <script type="application/json" data-for="year">{ "values": [1970, 1971, 1972, 1973, 1974, 1975, 1976, 1977, 1978, 1979, 1980, 1981, 1982, 1983, 1984, 1985, 1986, 1987, 1988, 1989, 1990, 1991, 1992, 1993, 1994, 1995, 1996, 1997, 1998, 1999, 2000, 2001, 2002, 2003, 2004, 2005, 2006, 2007, 2008, 2009, 2010, 2011, 2012, 2013, 2014, 2015, 2016, 2017, 2018, 2019, 2020], "keys": ["52", "51", "50", "49", "48", "47", "46", "45", "44", "43", "42", "41", "40", "39", "38", "37", "36", "35", "34", "33", "32", "31", "30", "29", "28", "27", "26", "25", "24", "23", "22", "21", "20", "19", "18", "17", "16", "15", "14", "13", "12", "11", "10", "9", "8", "7", "6", "5", "4", "3", "2"], "group": ["SharedData1e90ebfd"] }</script> </div> </div> </div> </div> </div> <div class="col-xs-9"> <div id="htmlwidget-e687f4542e86b3e6064e" style="width:700px;height:500px;" class="plotly html-widget"></div> <script type="application/json" data-for="htmlwidget-e687f4542e86b3e6064e">{"x":{"visdat":{"22d48b491ccf2e":["function () ","plotlyVisDat"]},"cur_data":"22d48b491ccf2e","attrs":{"22d48b491ccf2e":{"x":{},"y":{},"alpha_stroke":1,"sizes":[10,100],"spans":[1,20],"type":"scatter","mode":"lines","color":{},"colors":"#800000","legendgroup":{},"showlegend":false,"inherit":true},"22d48b491ccf2e.1":{"x":{},"y":{},"alpha_stroke":1,"sizes":[10,100],"spans":[1,20],"type":"scatter","mode":"markers","color":{},"colors":"#800000","legendgroup":{},"showlegend":true,"inherit":true}},"layout":{"width":700,"height":500,"margin":{"b":40,"l":60,"t":25,"r":10},"xaxis":{"domain":[0,1],"automargin":true,"title":""},"yaxis":{"domain":[0,1],"automargin":true,"title":""},"images":[{"source":"https://avatars1.githubusercontent.com/u/26974715?s=400&u=d86c8a0a761e67fa2c4c2a881d4d2e6b503082d0&v=4","xref":"paper","yref":"paper","xanchor":"center","yanchor":"center","x":0.5,"y":1.072,"sizex":0.16,"sizey":0.16}],"legend":{"orientation":"h","xref":"paper","xanchor":"center","x":0.5},"annotations":[{"x":1,"y":-0.1,"text":"Source: The World Bank","showarrow":false,"xref":"paper","yref":"paper","xanchor":"right","yanchor":"auto","xshift":0,"yshift":0,"font":{"size":12}}],"autosize":true,"dragmode":"zoom","hovermode":"closest","showlegend":false},"source":"A","config":{"modeBarButtonsToAdd":["hoverclosest","hovercompare"],"showSendToCloud":false,"displaylogo":false,"modeBarButtonsToRemove":["sendDataToCloud","resetScale2d","pan2d","zoomIn2d","zoomOut2d"]},"data":[{"x":[1970,1971,1972,1973,1974,1975,1976,1977,1978,1979,1980,1981,1982,1983,1984,1985,1986,1987,1988,1989,1990,1991,1992,1993,1994,1995,1996,1997,1998,1999,2000,2001,2002,2003,2004,2005,2006,2007,2008,2009,2010,2011,2012,2013,2014,2015,2016,2017,2018,2019,2020],"y":[24.983502446589,25.1358219933186,25.360717344777,28.3948517281366,33.2410586638362,31.4388152255029,32.1262789434256,32.3992344922077,31.999842665677,34.2509802541388,37.1179149013092,37.3920301069613,35.899055753658,35.2314803355995,36.6627744329206,36.6814461694731,34.2904260572828,35.0042415039404,36.4150510699777,36.9993748314059,37.4869889146894,37.4774964956247,40.0642650194821,38.710231532862,40.9855738724487,43.0915880014723,43.1829774105192,45.0813665904668,45.4800147938945,45.9088230228472,50.5478774635043,49.463703511143,49.2652798769113,51.0062664665318,54.4389723212276,56.503119571433,58.7483118876727,59.0982910527779,60.738553114112,52.2598779150216,56.7063998904381,59.8967826089166,59.6660903025467,58.846336307325,58.2583271840214,55.8711192155183,54.063247400096,55.7780176674517,57.2694569314739,55.9732313337411,52.098071091669],"type":"scatter","mode":"lines","legendgroup":"World","showlegend":false,"key":["52","51","50","49","48","47","46","45","44","43","42","41","40","39","38","37","36","35","34","33","32","31","30","29","28","27","26","25","24","23","22","21","20","19","18","17","16","15","14","13","12","11","10","9","8","7","6","5","4","3","2"],"set":"SharedData1e90ebfd","name":"World","marker":{"color":"rgba(128,0,0,1)","line":{"color":"rgba(128,0,0,1)"}},"textfont":{"color":"rgba(128,0,0,1)"},"error_y":{"color":"rgba(128,0,0,1)"},"error_x":{"color":"rgba(128,0,0,1)"},"line":{"color":"rgba(128,0,0,1)"},"xaxis":"x","yaxis":"y","_isNestedKey":false,"frame":null},{"x":[2020,2019,2018,2017,2016,2015,2014,2013,2012,2011,2010,2009,2008,2007,2006,2005,2004,2003,2002,2001,2000,1999,1998,1997,1996,1995,1994,1993,1992,1991,1990,1989,1988,1987,1986,1985,1984,1983,1982,1981,1980,1979,1978,1977,1976,1975,1974,1973,1972,1971,1970],"y":[52.098071091669,55.9732313337411,57.2694569314739,55.7780176674517,54.063247400096,55.8711192155183,58.2583271840214,58.846336307325,59.6660903025467,59.8967826089166,56.7063998904381,52.2598779150216,60.738553114112,59.0982910527779,58.7483118876727,56.503119571433,54.4389723212276,51.0062664665318,49.2652798769113,49.463703511143,50.5478774635043,45.9088230228472,45.4800147938945,45.0813665904668,43.1829774105192,43.0915880014723,40.9855738724487,38.710231532862,40.0642650194821,37.4774964956247,37.4869889146894,36.9993748314059,36.4150510699777,35.0042415039404,34.2904260572828,36.6814461694731,36.6627744329206,35.2314803355995,35.899055753658,37.3920301069613,37.1179149013092,34.2509802541388,31.999842665677,32.3992344922077,32.1262789434256,31.4388152255029,33.2410586638362,28.3948517281366,25.360717344777,25.1358219933186,24.983502446589],"type":"scatter","mode":"markers","legendgroup":"World","showlegend":true,"key":["2","3","4","5","6","7","8","9","10","11","12","13","14","15","16","17","18","19","20","21","22","23","24","25","26","27","28","29","30","31","32","33","34","35","36","37","38","39","40","41","42","43","44","45","46","47","48","49","50","51","52"],"set":"SharedData1e90ebfd","name":"World","marker":{"color":"rgba(128,0,0,1)","line":{"color":"rgba(128,0,0,1)"}},"textfont":{"color":"rgba(128,0,0,1)"},"error_y":{"color":"rgba(128,0,0,1)"},"error_x":{"color":"rgba(128,0,0,1)"},"line":{"color":"rgba(128,0,0,1)"},"xaxis":"x","yaxis":"y","_isNestedKey":false,"frame":null}],"highlight":{"on":"plotly_click","persistent":false,"dynamic":false,"selectize":false,"opacityDim":0.2,"selected":{"opacity":1},"debounce":0,"ctGroups":["SharedData1e90ebfd"]},"shinyEvents":["plotly_hover","plotly_click","plotly_selected","plotly_relayout","plotly_brushed","plotly_brushing","plotly_clickannotation","plotly_doubleclick","plotly_deselect","plotly_afterplot","plotly_sunburstclick"],"base_url":"https://plot.ly"},"evals":[],"jsHooks":[]}</script> </div> </div> </div> --- ## 1. Comparative Advantage of Nations * Adam Smith argued in the Wealth of Nations (1776) that: * Some countries can produce more of a product with the same amount of input than other countries * A country should produce only goods where it is most efficient, and trade for those goods where it is not efficient * Assumes there is an absolute balance among nations --- ### 1. Comparative Advantage of Nations In 1817, David Ricardo, a businessman, economist, and member of the British Parliament, wrote a treatise called *On the Principles of Political Economy and Taxation*. - In this treatise, Ricardo argued that specialization and free trade benefit all trading partners, even those that may be relatively inefficient. To see what he meant, we must be able to distinguish between **absolute and comparative advantage**. - A country has an **absolute advantage** in producing a good over another country if it uses fewer resources to produce that good. --- .panelset[ .panel[.panel-name[Example 1] Saudi Arabia can produce oil with fewer resources, while the United States can produce corn with fewer resources. Table 1 illustrates the advantages of the two countries, expressed in terms of how many hours it takes to produce one unit of each good. | Country | Oil (hours per barrel) | Corn (hours per bushel) | |---------|-------------------|-----------------------------| | Saudi Arabia | 1 | 4 | | United States | 2 | 1 | Table 1. How Many Hours It Takes to Produce Oil and Corn - Saudi Arabia has an absolute advantage in the production of oil because it only takes an hour to produce a barrel of oil compared to two hours in the United States. - The United States has an absolute advantage in the production of corn. ] .panel[.panel-name[Ex 2] To simplify, let’s say that Saudi Arabia and the United States each have 100 worker hours (see Table 2). - We illustrate what each country is capable of producing on its own using a **production possibility frontier** (PPF) graph. | Country | Oil production using 100 worker hours (barrels) | Corn production using 100 worker hours (bushels) | |---------|-------------------|-----------------------------| | Saudi Arabia | 100 | or 25 | | United States | 50 | or 100 | Table 2. Production Possibilities before Trade ] .panel[.panel-name[Ex 3]  | Country | Oil Production (barrels) | Corn Production (bushels) | |---------|-------------------|-----------------------------| | Saudi Arabia | 60 | 10 | | United States | 20 | 60 | | Total World Production | 80 | 70 | Table 3. Production before Trade ] .panel[.panel-name[Ex 4] - The **slope of the production possibility frontier** illustrates the opportunity cost of producing oil in terms of corn. - Using all its resources, the United States can produce 50 barrels of oil or 100 bushels of corn. - So the opportunity cost of one barrel of oil is two bushels of corn—or the slope is 1/2. Thus, in the U.S. production possibility frontier graph, every increase in oil production of one barrel implies a decrease of two bushels of corn. - Saudi Arabia can produce 100 barrels of oil or 25 bushels of corn. The opportunity cost of producing one barrel of oil is the loss of 1/4 of a bushel of corn that Saudi workers could otherwise have produced. In terms of corn, notice that Saudi Arabia gives up the least to produce a barrel of oil. ] .panel[.panel-name[Ex 5] | Country | Opportunity cost of 1 unit of oil in terms of corn | Opportunity cost of 1 unit of corn in terms of oil | |---------|-------------------|-----------------------------| | Saudi Arabia | 1/4 | 4 | | United States | 2 | 1/1 | Table 4. Opportunity Cost and Comparative Advantage ] .panel[.panel-name[Ex 6] Again recall that comparative advantage was defined as the opportunity cost of producing goods. - Since Saudi Arabia gives up the least to produce a barrel of oil, (1/4 < 2 in Table 3) it has a comparative advantage in oil production. - The United States gives up the least to produce a bushel of corn, so it has a comparative advantage in corn production. ] .panel[.panel-name[Ex 7] Recall that David Ricardo argued that if each country specializes in its comparative advantage, it will benefit from trade, and total global output will increase. > How can we show gains from trade as a result of comparative advantage and specialization? Table 4 shows the output assuming that each country specializes in its comparative advantage and produces no other good. - This is 100% specialization. Specialization leads to an increase in total world production. | Country | Quantity produced after 100% specialization — Oil (barrels) | Quantity produced after 100% specialization — Corn (bushels) | |---------|-------------------|-----------------------------| | Saudi Arabia | 100 | 0 | | United States | 0 | 100 | | Total World Production | 100 | 100 | Table 5. How Specialization Expands Output ] ] --- class: inverse, center, middle ## Wait! > It seems a bit simplistic, can we capture other social dynamics? Such as international capital, technology, migration flows, etc. --- ### Natural Ressources: Not a Guarantee of Wealth <div class="container-fluid crosstalk-bscols"> <div class="row"> <div class="col-xs-3"> <div class="container-fluid crosstalk-bscols"> <div class="row"> <div class="col-xs-12"> <div id="country" class="form-group crosstalk-input-select crosstalk-input"> <label class="control-label" for="country">Region</label> <div> <select multiple></select> <script type="application/json" data-for="country">{ "items": { "value": ["East Asia & Pacific", "Europe & Central Asia", "Latin America & Caribbean", "Middle East & North Africa", "North America", "South Asia", "Sub-Saharan Africa"], "label": ["East Asia & Pacific", "Europe & Central Asia", "Latin America & Caribbean", "Middle East & North Africa", "North America", "South Asia", "Sub-Saharan Africa"] }, "map": { "East Asia & Pacific": ["2", "3", "4", "5", "6", "7", "8", "9", "10", "11", "12", "13", "14", "15", "16", "17", "18", "19", "20", "21", "22", "23", "24", "25", "26", "27", "28", "29", "30", "31", "32", "33", "34", "35", "36", "37", "38", "39", "40", "41", "42", "43", "44", "45", "46", "47", "48", "49", "50", "51", "52"], "Europe & Central Asia": ["54", "55", "56", "57", "58", "59", "60", "61", "62", "63", "64", "65", "66", "67", "68", "69", "70", "71", "72", "73", "74", "75", "76", "77", "78", "79", "80", "81", "82", "83", "84", "85", "86", "87", "88", "89", "90", "91", "92", "93", "94", "95", "96", "97", "98", "99", "100", "101", "102", "103", "104"], "Latin America & Caribbean": ["106", "107", "108", "109", "110", "111", "112", "113", "114", "115", "116", "117", "118", "119", "120", "121", "122", "123", "124", "125", "126", "127", "128", "129", "130", "131", "132", "133", "134", "135", "136", "137", "138", "139", "140", "141", "142", "143", "144", "145", "146", "147", "148", "149", "150", "151", "152", "153", "154", "155", "156"], "Middle East & North Africa": ["158", "159", "160", "161", "162", "163", "164", "165", "166", "167", "168", "169", "170", "171", "172", "173", "174", "175", "176", "177", "178", "179", "180", "181", "182", "183", "184", "185", "186", "187", "188", "189", "190", "191", "192", "193", "194", "195", "196", "197", "198", "199", "200", "201", "202", "203", "204", "205", "206", "207", "208"], "North America": ["210", "211", "212", "213", "214", "215", "216", "217", "218", "219", "220", "221", "222", "223", "224", "225", "226", "227", "228", "229", "230", "231", "232", "233", "234", "235", "236", "237", "238", "239", "240", "241", "242", "243", "244", "245", "246", "247", "248", "249", "250", "251", "252", "253", "254", "255", "256", "257", "258", "259", "260"], "South Asia": ["262", "263", "264", "265", "266", "267", "268", "269", "270", "271", "272", "273", "274", "275", "276", "277", "278", "279", "280", "281", "282", "283", "284", "285", "286", "287", "288", "289", "290", "291", "292", "293", "294", "295", "296", "297", "298", "299", "300", "301", "302", "303", "304", "305", "306", "307", "308", "309", "310", "311", "312"], "Sub-Saharan Africa": ["314", "315", "316", "317", "318", "319", "320", "321", "322", "323", "324", "325", "326", "327", "328", "329", "330", "331", "332", "333", "334", "335", "336", "337", "338", "339", "340", "341", "342", "343", "344", "345", "346", "347", "348", "349", "350", "351", "352", "353", "354", "355", "356", "357", "358", "359", "360", "361", "362", "363", "364"] }, "group": ["SharedDatae687f454"] }</script> </div> </div> </div> <div class="col-xs-12"> <div class="form-group crosstalk-input crosstalk-input-slider js-range-slider" id="year"> <label class="control-label" for="year">Year</label> <input data-skin="shiny" data-type="double" data-min="1970" data-max="2020" data-from="1970" data-to="2020" data-step="1" data-grid="true" data-grid-num="10" data-grid-snap="false" data-prettify-separator="" data-keyboard="true" data-keyboard-step="2" data-drag-interval="true" data-data-type="number"/> <script type="application/json" data-for="year">{ "values": [1970, 1970, 1970, 1970, 1970, 1970, 1970, 1971, 1971, 1971, 1971, 1971, 1971, 1971, 1972, 1972, 1972, 1972, 1972, 1972, 1972, 1973, 1973, 1973, 1973, 1973, 1973, 1973, 1974, 1974, 1974, 1974, 1974, 1974, 1974, 1975, 1975, 1975, 1975, 1975, 1975, 1975, 1976, 1976, 1976, 1976, 1976, 1976, 1976, 1977, 1977, 1977, 1977, 1977, 1977, 1977, 1978, 1978, 1978, 1978, 1978, 1978, 1978, 1979, 1979, 1979, 1979, 1979, 1979, 1979, 1980, 1980, 1980, 1980, 1980, 1980, 1980, 1981, 1981, 1981, 1981, 1981, 1981, 1981, 1982, 1982, 1982, 1982, 1982, 1982, 1982, 1983, 1983, 1983, 1983, 1983, 1983, 1983, 1984, 1984, 1984, 1984, 1984, 1984, 1984, 1985, 1985, 1985, 1985, 1985, 1985, 1985, 1986, 1986, 1986, 1986, 1986, 1986, 1986, 1987, 1987, 1987, 1987, 1987, 1987, 1987, 1988, 1988, 1988, 1988, 1988, 1988, 1988, 1989, 1989, 1989, 1989, 1989, 1989, 1989, 1990, 1990, 1990, 1990, 1990, 1990, 1990, 1991, 1991, 1991, 1991, 1991, 1991, 1991, 1992, 1992, 1992, 1992, 1992, 1992, 1992, 1993, 1993, 1993, 1993, 1993, 1993, 1993, 1994, 1994, 1994, 1994, 1994, 1994, 1994, 1995, 1995, 1995, 1995, 1995, 1995, 1995, 1996, 1996, 1996, 1996, 1996, 1996, 1996, 1997, 1997, 1997, 1997, 1997, 1997, 1997, 1998, 1998, 1998, 1998, 1998, 1998, 1998, 1999, 1999, 1999, 1999, 1999, 1999, 1999, 2000, 2000, 2000, 2000, 2000, 2000, 2000, 2001, 2001, 2001, 2001, 2001, 2001, 2001, 2002, 2002, 2002, 2002, 2002, 2002, 2002, 2003, 2003, 2003, 2003, 2003, 2003, 2003, 2004, 2004, 2004, 2004, 2004, 2004, 2004, 2005, 2005, 2005, 2005, 2005, 2005, 2005, 2006, 2006, 2006, 2006, 2006, 2006, 2006, 2007, 2007, 2007, 2007, 2007, 2007, 2007, 2008, 2008, 2008, 2008, 2008, 2008, 2008, 2009, 2009, 2009, 2009, 2009, 2009, 2009, 2010, 2010, 2010, 2010, 2010, 2010, 2010, 2011, 2011, 2011, 2011, 2011, 2011, 2011, 2012, 2012, 2012, 2012, 2012, 2012, 2012, 2013, 2013, 2013, 2013, 2013, 2013, 2013, 2014, 2014, 2014, 2014, 2014, 2014, 2014, 2015, 2015, 2015, 2015, 2015, 2015, 2015, 2016, 2016, 2016, 2016, 2016, 2016, 2016, 2017, 2017, 2017, 2017, 2017, 2017, 2017, 2018, 2018, 2018, 2018, 2018, 2018, 2018, 2019, 2019, 2019, 2019, 2019, 2019, 2019, 2020, 2020, 2020, 2020, 2020, 2020, 2020], "keys": ["52", "104", "156", "208", "260", "312", "364", "51", "103", "155", "207", "259", "311", "363", "50", "102", "154", "206", "258", "310", "362", "49", "101", "153", "205", "257", "309", "361", "48", "100", "152", "204", "256", "308", "360", "47", "99", "151", "203", "255", "307", "359", "46", "98", "150", "202", "254", "306", "358", "45", "97", "149", "201", "253", "305", "357", "44", "96", "148", "200", "252", "304", "356", "43", "95", "147", "199", "251", "303", "355", "42", "94", "146", "198", "250", "302", "354", "41", "93", "145", "197", "249", "301", "353", "40", "92", "144", "196", "248", "300", "352", "39", "91", "143", "195", "247", "299", "351", "38", "90", "142", "194", "246", "298", "350", "37", "89", "141", "193", "245", "297", "349", "36", "88", "140", "192", "244", "296", "348", "35", "87", "139", "191", "243", "295", "347", "34", "86", "138", "190", "242", "294", "346", "33", "85", "137", "189", "241", "293", "345", "32", "84", "136", "188", "240", "292", "344", "31", "83", "135", "187", "239", "291", "343", "30", "82", "134", "186", "238", "290", "342", "29", "81", "133", "185", "237", "289", "341", "28", "80", "132", "184", "236", "288", "340", "27", "79", "131", "183", "235", "287", "339", "26", "78", "130", "182", "234", "286", "338", "25", "77", "129", "181", "233", "285", "337", "24", "76", "128", "180", "232", "284", "336", "23", "75", "127", "179", "231", "283", "335", "22", "74", "126", "178", "230", "282", "334", "21", "73", "125", "177", "229", "281", "333", "20", "72", "124", "176", "228", "280", "332", "19", "71", "123", "175", "227", "279", "331", "18", "70", "122", "174", "226", "278", "330", "17", "69", "121", "173", "225", "277", "329", "16", "68", "120", "172", "224", "276", "328", "15", "67", "119", "171", "223", "275", "327", "14", "66", "118", "170", "222", "274", "326", "13", "65", "117", "169", "221", "273", "325", "12", "64", "116", "168", "220", "272", "324", "11", "63", "115", "167", "219", "271", "323", "10", "62", "114", "166", "218", "270", "322", "9", "61", "113", "165", "217", "269", "321", "8", "60", "112", "164", "216", "268", "320", "7", "59", "111", "163", "215", "267", "319", "6", "58", "110", "162", "214", "266", "318", "5", "57", "109", "161", "213", "265", "317", "4", "56", "108", "160", "212", "264", "316", "3", "55", "107", "159", "211", "263", "315", "2", "54", "106", "158", "210", "262", "314"], "group": ["SharedDatae687f454"] }</script> </div> </div> </div> </div> </div> <div class="col-xs-9"> <div id="htmlwidget-b75b7f08e202fd675756" style="width:700px;height:500px;" class="plotly html-widget"></div> <script type="application/json" data-for="htmlwidget-b75b7f08e202fd675756">{"x":{"visdat":{"22d48b35c6858b":["function () ","plotlyVisDat"]},"cur_data":"22d48b35c6858b","attrs":{"22d48b35c6858b":{"x":{},"y":{},"alpha_stroke":1,"sizes":[10,100],"spans":[1,20],"type":"scatter","mode":"lines","color":{},"colors":["#800000","#767676","#FFA319","#8A9045","#155F83","#C16622","#8F3931"],"legendgroup":{},"showlegend":false,"inherit":true},"22d48b35c6858b.1":{"x":{},"y":{},"alpha_stroke":1,"sizes":[10,100],"spans":[1,20],"type":"scatter","mode":"markers","color":{},"colors":["#800000","#767676","#FFA319","#8A9045","#155F83","#C16622","#8F3931"],"legendgroup":{},"showlegend":true,"inherit":true}},"layout":{"width":700,"height":500,"margin":{"b":40,"l":60,"t":25,"r":10},"xaxis":{"domain":[0,1],"automargin":true,"title":""},"yaxis":{"domain":[0,1],"automargin":true,"title":""},"images":[{"source":"https://avatars1.githubusercontent.com/u/26974715?s=400&u=d86c8a0a761e67fa2c4c2a881d4d2e6b503082d0&v=4","xref":"paper","yref":"paper","xanchor":"center","yanchor":"center","x":0.5,"y":1.072,"sizex":0.16,"sizey":0.16}],"legend":{"orientation":"h","xref":"paper","xanchor":"center","x":0.5},"annotations":[{"x":1,"y":-0.1,"text":"Source: The World Bank","showarrow":false,"xref":"paper","yref":"paper","xanchor":"right","yanchor":"auto","xshift":0,"yshift":0,"font":{"size":12}}],"autosize":true,"dragmode":"zoom","hovermode":"closest","showlegend":true},"source":"A","config":{"modeBarButtonsToAdd":["hoverclosest","hovercompare"],"showSendToCloud":false,"displaylogo":false,"modeBarButtonsToRemove":["sendDataToCloud","resetScale2d","pan2d","zoomIn2d","zoomOut2d"]},"data":[{"x":[1970,1971,1972,1973,1974,1975,1976,1977,1978,1979,1980,1981,1982,1983,1984,1985,1986,1987,1988,1989,1990,1991,1992,1993,1994,1995,1996,1997,1998,1999,2000,2001,2002,2003,2004,2005,2006,2007,2008,2009,2010,2011,2012,2013,2014,2015,2016,2017,2018,2019,2020],"y":[0.87584903289934,0.891432809351317,0.989848394997626,1.54221455840756,2.58790910783726,3.00291100536233,3.24891078762671,3.22940306458033,2.49856211736596,4.15676808562383,4.67074550669381,3.79614799648197,3.36427435037075,2.96252646774304,2.5684270329846,2.58258831228659,1.30728188626281,1.26044576601626,1.18016947969771,1.33745598116889,1.52911845951089,1.03554733190181,0.961561294230435,0.788719894666801,0.689009579798165,0.74275220437105,0.840234273672971,0.777662949654837,0.650270202974211,0.648916747906644,0.964592430748649,0.972472285821916,0.870223434777386,0.933909940310022,1.64085196097248,2.03838401993113,2.49835914545847,3.12867451989161,4.71982856476135,2.2965505514799,3.5067387690173,4.3904362021657,2.73937249273054,2.3544683949746,1.97839753664986,1.18180910399939,1.05288172281035,1.33957631407296,1.54598811303275,1.30517030154432,1.20021861656219],"type":"scatter","mode":"lines","legendgroup":"East Asia & Pacific","showlegend":false,"key":["52","51","50","49","48","47","46","45","44","43","42","41","40","39","38","37","36","35","34","33","32","31","30","29","28","27","26","25","24","23","22","21","20","19","18","17","16","15","14","13","12","11","10","9","8","7","6","5","4","3","2"],"set":"SharedDatae687f454","name":"East Asia & Pacific","marker":{"color":"rgba(128,0,0,1)","line":{"color":"rgba(128,0,0,1)"}},"textfont":{"color":"rgba(128,0,0,1)"},"error_y":{"color":"rgba(128,0,0,1)"},"error_x":{"color":"rgba(128,0,0,1)"},"line":{"color":"rgba(128,0,0,1)"},"xaxis":"x","yaxis":"y","_isNestedKey":false,"frame":null},{"x":[1970,1971,1972,1973,1974,1975,1976,1977,1978,1979,1980,1981,1982,1983,1984,1985,1986,1987,1988,1989,1990,1991,1992,1993,1994,1995,1996,1997,1998,1999,2000,2001,2002,2003,2004,2005,2006,2007,2008,2009,2010,2011,2012,2013,2014,2015,2016,2017,2018,2019,2020],"y":[0.222633377922991,0.208331549148484,0.186398355310602,0.240263846535045,0.38541472149494,0.527749371084163,0.590659456263412,0.55707638403658,0.490191393971911,0.75775388287288,0.875562091885414,0.920774572719789,0.727483733419964,0.845262246097141,0.866080666527888,0.90486366242627,0.390051175267408,0.425896947746915,0.823116963080304,1.12299341397923,1.34317724741398,0.70680159427639,0.732861488136139,0.694912248907461,0.578233541205294,0.571492945779655,0.709191537289962,0.633740060506516,0.257074422284213,0.481448823849055,1.21820353694439,1.25728112178927,1.11555227219425,1.08584906591796,1.22232749130817,1.51791213280101,1.89830671222149,1.85920245720394,2.4915937901279,1.64474422635369,2.1642015128715,2.84404956928357,2.69348179103481,2.33997344189285,1.95320798908175,1.16544707616083,0.970113191922968,1.38503988624633,1.89240323808808,1.58399619668753,1.19938166440234],"type":"scatter","mode":"lines","legendgroup":"Europe & Central Asia","showlegend":false,"key":["104","103","102","101","100","99","98","97","96","95","94","93","92","91","90","89","88","87","86","85","84","83","82","81","80","79","78","77","76","75","74","73","72","71","70","69","68","67","66","65","64","63","62","61","60","59","58","57","56","55","54"],"set":"SharedDatae687f454","name":"Europe & Central Asia","marker":{"color":"rgba(118,118,118,1)","line":{"color":"rgba(118,118,118,1)"}},"textfont":{"color":"rgba(118,118,118,1)"},"error_y":{"color":"rgba(118,118,118,1)"},"error_x":{"color":"rgba(118,118,118,1)"},"line":{"color":"rgba(118,118,118,1)"},"xaxis":"x","yaxis":"y","_isNestedKey":false,"frame":null},{"x":[1970,1971,1972,1973,1974,1975,1976,1977,1978,1979,1980,1981,1982,1983,1984,1985,1986,1987,1988,1989,1990,1991,1992,1993,1994,1995,1996,1997,1998,1999,2000,2001,2002,2003,2004,2005,2006,2007,2008,2009,2010,2011,2012,2013,2014,2015,2016,2017,2018,2019,2020],"y":[2.31721313567865,2.0966061284491,2.03124241251817,2.59856819138008,5.67665488632308,4.69845571613725,4.72589433374473,4.1236879997494,3.99820944170786,8.03474044777974,8.53037398194222,6.55487020704766,5.34200003465612,7.04825181961406,6.8758710061488,6.42142134931371,3.31950066097456,4.65120769712472,4.13651879892336,5.32173345566735,5.7380111620824,3.45992074030033,3.30052117658294,2.70145675946747,2.34197915220072,2.64095657992472,3.01072493003646,2.5415881010015,1.55666304261477,2.51381541431434,3.80243613790186,2.99829881359511,3.53185307613565,4.12522168627486,5.19876454959303,6.44922469401157,7.26042319866188,6.77980653644972,7.21696258609019,3.99868111678407,5.18890807947334,6.51395076025852,5.84180335192066,5.37137781018107,4.54473170726038,2.2906975312057,2.16581111912191,2.72477344825017,3.42781008144489,2.99963696410789,2.76120430271059],"type":"scatter","mode":"lines","legendgroup":"Latin America & Caribbean","showlegend":false,"key":["156","155","154","153","152","151","150","149","148","147","146","145","144","143","142","141","140","139","138","137","136","135","134","133","132","131","130","129","128","127","126","125","124","123","122","121","120","119","118","117","116","115","114","113","112","111","110","109","108","107","106"],"set":"SharedDatae687f454","name":"Latin America & Caribbean","marker":{"color":"rgba(255,163,25,1)","line":{"color":"rgba(255,163,25,1)"}},"textfont":{"color":"rgba(255,163,25,1)"},"error_y":{"color":"rgba(255,163,25,1)"},"error_x":{"color":"rgba(255,163,25,1)"},"line":{"color":"rgba(255,163,25,1)"},"xaxis":"x","yaxis":"y","_isNestedKey":false,"frame":null},{"x":[1970,1971,1972,1973,1974,1975,1976,1977,1978,1979,1980,1981,1982,1983,1984,1985,1986,1987,1988,1989,1990,1991,1992,1993,1994,1995,1996,1997,1998,1999,2000,2001,2002,2003,2004,2005,2006,2007,2008,2009,2010,2011,2012,2013,2014,2015,2016,2017,2018,2019,2020],"y":[14.6883179428537,16.2885963585509,18.2167395466573,22.2689981874656,50.7739060595079,40.6173331452616,39.7179483307762,37.3557831285186,34.083923161854,52.8143850696137,47.4010309697983,35.1142130309576,23.1048851360655,21.9658220785314,20.9494037428911,18.3128976528674,10.6474431992602,16.3039060874318,15.5757300440195,22.7111279793003,24.3485992276323,20.8092091306683,21.0406090966324,21.4655823005968,19.2852323331746,16.3296432743156,18.2286802629018,16.2166073900769,10.990223368727,14.6550775279184,23.3055496663047,18.8481323850691,18.1454996192316,20.2959109574621,24.3037686237637,30.9903010186633,31.6472785388246,28.3268012062654,32.4152311644514,20.4285437893397,23.6799677434921,32.0680391510906,31.0639649219375,29.4625834900093,26.5475285053951,15.6829913771381,12.8578394271525,16.4629729353259,22.0141398144477,18.5060692189301,12.9417419316516],"type":"scatter","mode":"lines","legendgroup":"Middle East & North Africa","showlegend":false,"key":["208","207","206","205","204","203","202","201","200","199","198","197","196","195","194","193","192","191","190","189","188","187","186","185","184","183","182","181","180","179","178","177","176","175","174","173","172","171","170","169","168","167","166","165","164","163","162","161","160","159","158"],"set":"SharedDatae687f454","name":"Middle East & North Africa","marker":{"color":"rgba(138,144,69,1)","line":{"color":"rgba(138,144,69,1)"}},"textfont":{"color":"rgba(138,144,69,1)"},"error_y":{"color":"rgba(138,144,69,1)"},"error_x":{"color":"rgba(138,144,69,1)"},"line":{"color":"rgba(138,144,69,1)"},"xaxis":"x","yaxis":"y","_isNestedKey":false,"frame":null},{"x":[1970,1971,1972,1973,1974,1975,1976,1977,1978,1979,1980,1981,1982,1983,1984,1985,1986,1987,1988,1989,1990,1991,1992,1993,1994,1995,1996,1997,1998,1999,2000,2001,2002,2003,2004,2005,2006,2007,2008,2009,2010,2011,2012,2013,2014,2015,2016,2017,2018,2019,2020],"y":[0.876688267145806,0.844206196886021,0.847338400780411,1.16792859191251,3.48864444753986,3.27958820130771,3.12882951036914,3.20482664364243,2.83286753256112,5.236304778875,5.8836230172222,4.25568345511359,2.50584668732307,2.85183822539542,2.63128336322718,2.30888205495615,1.0483217504697,1.4231657954594,1.19727027427412,1.30420535031758,1.45784539521006,1.08517230364511,1.10872547365091,1.06345933225947,0.896033031261567,0.940316166320224,1.15612578594253,0.908746352570599,0.576974347998981,0.720300600948407,1.20038691144246,1.05565008159221,0.725890254714627,0.959681057039221,1.43209129880996,1.52421058331203,1.35556518721023,1.2796884534744,2.2264961420696,0.884204818100672,1.11511619550654,1.49559357836893,0.957293179491089,0.915921629411612,0.766825201265143,0.243071423191147,0.339063147584083,0.503349571087567,0.78369531946322,0.68098460473214,0.495192147092504],"type":"scatter","mode":"lines","legendgroup":"North America","showlegend":false,"key":["260","259","258","257","256","255","254","253","252","251","250","249","248","247","246","245","244","243","242","241","240","239","238","237","236","235","234","233","232","231","230","229","228","227","226","225","224","223","222","221","220","219","218","217","216","215","214","213","212","211","210"],"set":"SharedDatae687f454","name":"North America","marker":{"color":"rgba(21,95,131,1)","line":{"color":"rgba(21,95,131,1)"}},"textfont":{"color":"rgba(21,95,131,1)"},"error_y":{"color":"rgba(21,95,131,1)"},"error_x":{"color":"rgba(21,95,131,1)"},"line":{"color":"rgba(21,95,131,1)"},"xaxis":"x","yaxis":"y","_isNestedKey":false,"frame":null},{"x":[1970,1971,1972,1973,1974,1975,1976,1977,1978,1979,1980,1981,1982,1983,1984,1985,1986,1987,1988,1989,1990,1991,1992,1993,1994,1995,1996,1997,1998,1999,2000,2001,2002,2003,2004,2005,2006,2007,2008,2009,2010,2011,2012,2013,2014,2015,2016,2017,2018,2019,2020],"y":[0.585277137031301,0.701732257909876,0.720476025829999,0.902400918001377,1.20889942796557,2.41934119796445,2.46461268763014,3.57773424305973,3.03571242239932,2.79279588745722,2.55814948827057,3.20182180353144,3.41696705841557,2.95431716317696,2.78997676558178,2.93149459790898,2.10559889140597,1.90797676899511,1.77365579966851,2.45743442163221,2.93210579365129,2.47985469918783,2.28528793171565,1.98277555634173,1.70437610490108,2.08535631083361,2.05443039979899,1.85053187928005,1.49501739783397,1.55385750120322,1.99921010430097,2.00579715359733,1.94094458356795,1.89060095600192,2.61708080360225,3.10863660828256,3.49272821763429,3.90264645395745,5.89492450923934,2.97297463121957,3.87287800026186,4.64307348069519,3.56256000263045,3.1607367287636,2.50366344408003,1.59402268354615,1.4826972911095,1.68067416026071,1.91286405465403,1.69651648263408,1.55215612500171],"type":"scatter","mode":"lines","legendgroup":"South Asia","showlegend":false,"key":["312","311","310","309","308","307","306","305","304","303","302","301","300","299","298","297","296","295","294","293","292","291","290","289","288","287","286","285","284","283","282","281","280","279","278","277","276","275","274","273","272","271","270","269","268","267","266","265","264","263","262"],"set":"SharedDatae687f454","name":"South Asia","marker":{"color":"rgba(193,102,34,1)","line":{"color":"rgba(193,102,34,1)"}},"textfont":{"color":"rgba(193,102,34,1)"},"error_y":{"color":"rgba(193,102,34,1)"},"error_x":{"color":"rgba(193,102,34,1)"},"line":{"color":"rgba(193,102,34,1)"},"xaxis":"x","yaxis":"y","_isNestedKey":false,"frame":null},{"x":[1970,1971,1972,1973,1974,1975,1976,1977,1978,1979,1980,1981,1982,1983,1984,1985,1986,1987,1988,1989,1990,1991,1992,1993,1994,1995,1996,1997,1998,1999,2000,2001,2002,2003,2004,2005,2006,2007,2008,2009,2010,2011,2012,2013,2014,2015,2016,2017,2018,2019,2020],"y":[4.42282044427999,4.01938792242889,3.78887061310129,5.4895378048187,12.0829990875764,9.82899260808236,10.0090575617805,11.3253181084379,9.52702139201712,17.31912952925,15.331379739173,6.98820859183282,6.61257531923003,7.43485625321937,7.98866753745988,9.64806394779036,7.21951897666772,8.25795346685897,8.35086550001435,10.5575638982083,10.6526486843235,7.65300590511661,8.52107280967508,8.05574794407208,9.01919368730684,9.36053394275299,10.3030939558398,8.7723428315509,6.63916910653856,6.50400119837688,9.92635800699168,8.57184195471215,8.4687647123447,8.46480888661974,10.3675299389301,12.7551339352434,13.2912961432126,13.9425933845845,18.558449079164,10.6292089762302,13.0709945040351,16.068304247538,13.779401139351,11.930415133445,10.2755242801352,6.33375464362749,6.51565823259701,8.10247264222744,8.64201135519056,7.79555325451991,6.7563405997071],"type":"scatter","mode":"lines","legendgroup":"Sub-Saharan Africa","showlegend":false,"key":["364","363","362","361","360","359","358","357","356","355","354","353","352","351","350","349","348","347","346","345","344","343","342","341","340","339","338","337","336","335","334","333","332","331","330","329","328","327","326","325","324","323","322","321","320","319","318","317","316","315","314"],"set":"SharedDatae687f454","name":"Sub-Saharan Africa","marker":{"color":"rgba(143,57,49,1)","line":{"color":"rgba(143,57,49,1)"}},"textfont":{"color":"rgba(143,57,49,1)"},"error_y":{"color":"rgba(143,57,49,1)"},"error_x":{"color":"rgba(143,57,49,1)"},"line":{"color":"rgba(143,57,49,1)"},"xaxis":"x","yaxis":"y","_isNestedKey":false,"frame":null},{"x":[2020,2019,2018,2017,2016,2015,2014,2013,2012,2011,2010,2009,2008,2007,2006,2005,2004,2003,2002,2001,2000,1999,1998,1997,1996,1995,1994,1993,1992,1991,1990,1989,1988,1987,1986,1985,1984,1983,1982,1981,1980,1979,1978,1977,1976,1975,1974,1973,1972,1971,1970],"y":[1.20021861656219,1.30517030154432,1.54598811303275,1.33957631407296,1.05288172281035,1.18180910399939,1.97839753664986,2.3544683949746,2.73937249273054,4.3904362021657,3.5067387690173,2.2965505514799,4.71982856476135,3.12867451989161,2.49835914545847,2.03838401993113,1.64085196097248,0.933909940310022,0.870223434777386,0.972472285821916,0.964592430748649,0.648916747906644,0.650270202974211,0.777662949654837,0.840234273672971,0.74275220437105,0.689009579798165,0.788719894666801,0.961561294230435,1.03554733190181,1.52911845951089,1.33745598116889,1.18016947969771,1.26044576601626,1.30728188626281,2.58258831228659,2.5684270329846,2.96252646774304,3.36427435037075,3.79614799648197,4.67074550669381,4.15676808562383,2.49856211736596,3.22940306458033,3.24891078762671,3.00291100536233,2.58790910783726,1.54221455840756,0.989848394997626,0.891432809351317,0.87584903289934],"type":"scatter","mode":"markers","legendgroup":"East Asia & Pacific","showlegend":true,"key":["2","3","4","5","6","7","8","9","10","11","12","13","14","15","16","17","18","19","20","21","22","23","24","25","26","27","28","29","30","31","32","33","34","35","36","37","38","39","40","41","42","43","44","45","46","47","48","49","50","51","52"],"set":"SharedDatae687f454","name":"East Asia & Pacific","marker":{"color":"rgba(128,0,0,1)","line":{"color":"rgba(128,0,0,1)"}},"textfont":{"color":"rgba(128,0,0,1)"},"error_y":{"color":"rgba(128,0,0,1)"},"error_x":{"color":"rgba(128,0,0,1)"},"line":{"color":"rgba(128,0,0,1)"},"xaxis":"x","yaxis":"y","_isNestedKey":false,"frame":null},{"x":[2020,2019,2018,2017,2016,2015,2014,2013,2012,2011,2010,2009,2008,2007,2006,2005,2004,2003,2002,2001,2000,1999,1998,1997,1996,1995,1994,1993,1992,1991,1990,1989,1988,1987,1986,1985,1984,1983,1982,1981,1980,1979,1978,1977,1976,1975,1974,1973,1972,1971,1970],"y":[1.19938166440234,1.58399619668753,1.89240323808808,1.38503988624633,0.970113191922968,1.16544707616083,1.95320798908175,2.33997344189285,2.69348179103481,2.84404956928357,2.1642015128715,1.64474422635369,2.4915937901279,1.85920245720394,1.89830671222149,1.51791213280101,1.22232749130817,1.08584906591796,1.11555227219425,1.25728112178927,1.21820353694439,0.481448823849055,0.257074422284213,0.633740060506516,0.709191537289962,0.571492945779655,0.578233541205294,0.694912248907461,0.732861488136139,0.70680159427639,1.34317724741398,1.12299341397923,0.823116963080304,0.425896947746915,0.390051175267408,0.90486366242627,0.866080666527888,0.845262246097141,0.727483733419964,0.920774572719789,0.875562091885414,0.75775388287288,0.490191393971911,0.55707638403658,0.590659456263412,0.527749371084163,0.38541472149494,0.240263846535045,0.186398355310602,0.208331549148484,0.222633377922991],"type":"scatter","mode":"markers","legendgroup":"Europe & Central Asia","showlegend":true,"key":["54","55","56","57","58","59","60","61","62","63","64","65","66","67","68","69","70","71","72","73","74","75","76","77","78","79","80","81","82","83","84","85","86","87","88","89","90","91","92","93","94","95","96","97","98","99","100","101","102","103","104"],"set":"SharedDatae687f454","name":"Europe & Central Asia","marker":{"color":"rgba(118,118,118,1)","line":{"color":"rgba(118,118,118,1)"}},"textfont":{"color":"rgba(118,118,118,1)"},"error_y":{"color":"rgba(118,118,118,1)"},"error_x":{"color":"rgba(118,118,118,1)"},"line":{"color":"rgba(118,118,118,1)"},"xaxis":"x","yaxis":"y","_isNestedKey":false,"frame":null},{"x":[2020,2019,2018,2017,2016,2015,2014,2013,2012,2011,2010,2009,2008,2007,2006,2005,2004,2003,2002,2001,2000,1999,1998,1997,1996,1995,1994,1993,1992,1991,1990,1989,1988,1987,1986,1985,1984,1983,1982,1981,1980,1979,1978,1977,1976,1975,1974,1973,1972,1971,1970],"y":[2.76120430271059,2.99963696410789,3.42781008144489,2.72477344825017,2.16581111912191,2.2906975312057,4.54473170726038,5.37137781018107,5.84180335192066,6.51395076025852,5.18890807947334,3.99868111678407,7.21696258609019,6.77980653644972,7.26042319866188,6.44922469401157,5.19876454959303,4.12522168627486,3.53185307613565,2.99829881359511,3.80243613790186,2.51381541431434,1.55666304261477,2.5415881010015,3.01072493003646,2.64095657992472,2.34197915220072,2.70145675946747,3.30052117658294,3.45992074030033,5.7380111620824,5.32173345566735,4.13651879892336,4.65120769712472,3.31950066097456,6.42142134931371,6.8758710061488,7.04825181961406,5.34200003465612,6.55487020704766,8.53037398194222,8.03474044777974,3.99820944170786,4.1236879997494,4.72589433374473,4.69845571613725,5.67665488632308,2.59856819138008,2.03124241251817,2.0966061284491,2.31721313567865],"type":"scatter","mode":"markers","legendgroup":"Latin America & Caribbean","showlegend":true,"key":["106","107","108","109","110","111","112","113","114","115","116","117","118","119","120","121","122","123","124","125","126","127","128","129","130","131","132","133","134","135","136","137","138","139","140","141","142","143","144","145","146","147","148","149","150","151","152","153","154","155","156"],"set":"SharedDatae687f454","name":"Latin America & Caribbean","marker":{"color":"rgba(255,163,25,1)","line":{"color":"rgba(255,163,25,1)"}},"textfont":{"color":"rgba(255,163,25,1)"},"error_y":{"color":"rgba(255,163,25,1)"},"error_x":{"color":"rgba(255,163,25,1)"},"line":{"color":"rgba(255,163,25,1)"},"xaxis":"x","yaxis":"y","_isNestedKey":false,"frame":null},{"x":[2020,2019,2018,2017,2016,2015,2014,2013,2012,2011,2010,2009,2008,2007,2006,2005,2004,2003,2002,2001,2000,1999,1998,1997,1996,1995,1994,1993,1992,1991,1990,1989,1988,1987,1986,1985,1984,1983,1982,1981,1980,1979,1978,1977,1976,1975,1974,1973,1972,1971,1970],"y":[12.9417419316516,18.5060692189301,22.0141398144477,16.4629729353259,12.8578394271525,15.6829913771381,26.5475285053951,29.4625834900093,31.0639649219375,32.0680391510906,23.6799677434921,20.4285437893397,32.4152311644514,28.3268012062654,31.6472785388246,30.9903010186633,24.3037686237637,20.2959109574621,18.1454996192316,18.8481323850691,23.3055496663047,14.6550775279184,10.990223368727,16.2166073900769,18.2286802629018,16.3296432743156,19.2852323331746,21.4655823005968,21.0406090966324,20.8092091306683,24.3485992276323,22.7111279793003,15.5757300440195,16.3039060874318,10.6474431992602,18.3128976528674,20.9494037428911,21.9658220785314,23.1048851360655,35.1142130309576,47.4010309697983,52.8143850696137,34.083923161854,37.3557831285186,39.7179483307762,40.6173331452616,50.7739060595079,22.2689981874656,18.2167395466573,16.2885963585509,14.6883179428537],"type":"scatter","mode":"markers","legendgroup":"Middle East & North Africa","showlegend":true,"key":["158","159","160","161","162","163","164","165","166","167","168","169","170","171","172","173","174","175","176","177","178","179","180","181","182","183","184","185","186","187","188","189","190","191","192","193","194","195","196","197","198","199","200","201","202","203","204","205","206","207","208"],"set":"SharedDatae687f454","name":"Middle East & North Africa","marker":{"color":"rgba(138,144,69,1)","line":{"color":"rgba(138,144,69,1)"}},"textfont":{"color":"rgba(138,144,69,1)"},"error_y":{"color":"rgba(138,144,69,1)"},"error_x":{"color":"rgba(138,144,69,1)"},"line":{"color":"rgba(138,144,69,1)"},"xaxis":"x","yaxis":"y","_isNestedKey":false,"frame":null},{"x":[2020,2019,2018,2017,2016,2015,2014,2013,2012,2011,2010,2009,2008,2007,2006,2005,2004,2003,2002,2001,2000,1999,1998,1997,1996,1995,1994,1993,1992,1991,1990,1989,1988,1987,1986,1985,1984,1983,1982,1981,1980,1979,1978,1977,1976,1975,1974,1973,1972,1971,1970],"y":[0.495192147092504,0.68098460473214,0.78369531946322,0.503349571087567,0.339063147584083,0.243071423191147,0.766825201265143,0.915921629411612,0.957293179491089,1.49559357836893,1.11511619550654,0.884204818100672,2.2264961420696,1.2796884534744,1.35556518721023,1.52421058331203,1.43209129880996,0.959681057039221,0.725890254714627,1.05565008159221,1.20038691144246,0.720300600948407,0.576974347998981,0.908746352570599,1.15612578594253,0.940316166320224,0.896033031261567,1.06345933225947,1.10872547365091,1.08517230364511,1.45784539521006,1.30420535031758,1.19727027427412,1.4231657954594,1.0483217504697,2.30888205495615,2.63128336322718,2.85183822539542,2.50584668732307,4.25568345511359,5.8836230172222,5.236304778875,2.83286753256112,3.20482664364243,3.12882951036914,3.27958820130771,3.48864444753986,1.16792859191251,0.847338400780411,0.844206196886021,0.876688267145806],"type":"scatter","mode":"markers","legendgroup":"North America","showlegend":true,"key":["210","211","212","213","214","215","216","217","218","219","220","221","222","223","224","225","226","227","228","229","230","231","232","233","234","235","236","237","238","239","240","241","242","243","244","245","246","247","248","249","250","251","252","253","254","255","256","257","258","259","260"],"set":"SharedDatae687f454","name":"North America","marker":{"color":"rgba(21,95,131,1)","line":{"color":"rgba(21,95,131,1)"}},"textfont":{"color":"rgba(21,95,131,1)"},"error_y":{"color":"rgba(21,95,131,1)"},"error_x":{"color":"rgba(21,95,131,1)"},"line":{"color":"rgba(21,95,131,1)"},"xaxis":"x","yaxis":"y","_isNestedKey":false,"frame":null},{"x":[2020,2019,2018,2017,2016,2015,2014,2013,2012,2011,2010,2009,2008,2007,2006,2005,2004,2003,2002,2001,2000,1999,1998,1997,1996,1995,1994,1993,1992,1991,1990,1989,1988,1987,1986,1985,1984,1983,1982,1981,1980,1979,1978,1977,1976,1975,1974,1973,1972,1971,1970],"y":[1.55215612500171,1.69651648263408,1.91286405465403,1.68067416026071,1.4826972911095,1.59402268354615,2.50366344408003,3.1607367287636,3.56256000263045,4.64307348069519,3.87287800026186,2.97297463121957,5.89492450923934,3.90264645395745,3.49272821763429,3.10863660828256,2.61708080360225,1.89060095600192,1.94094458356795,2.00579715359733,1.99921010430097,1.55385750120322,1.49501739783397,1.85053187928005,2.05443039979899,2.08535631083361,1.70437610490108,1.98277555634173,2.28528793171565,2.47985469918783,2.93210579365129,2.45743442163221,1.77365579966851,1.90797676899511,2.10559889140597,2.93149459790898,2.78997676558178,2.95431716317696,3.41696705841557,3.20182180353144,2.55814948827057,2.79279588745722,3.03571242239932,3.57773424305973,2.46461268763014,2.41934119796445,1.20889942796557,0.902400918001377,0.720476025829999,0.701732257909876,0.585277137031301],"type":"scatter","mode":"markers","legendgroup":"South Asia","showlegend":true,"key":["262","263","264","265","266","267","268","269","270","271","272","273","274","275","276","277","278","279","280","281","282","283","284","285","286","287","288","289","290","291","292","293","294","295","296","297","298","299","300","301","302","303","304","305","306","307","308","309","310","311","312"],"set":"SharedDatae687f454","name":"South Asia","marker":{"color":"rgba(193,102,34,1)","line":{"color":"rgba(193,102,34,1)"}},"textfont":{"color":"rgba(193,102,34,1)"},"error_y":{"color":"rgba(193,102,34,1)"},"error_x":{"color":"rgba(193,102,34,1)"},"line":{"color":"rgba(193,102,34,1)"},"xaxis":"x","yaxis":"y","_isNestedKey":false,"frame":null},{"x":[2020,2019,2018,2017,2016,2015,2014,2013,2012,2011,2010,2009,2008,2007,2006,2005,2004,2003,2002,2001,2000,1999,1998,1997,1996,1995,1994,1993,1992,1991,1990,1989,1988,1987,1986,1985,1984,1983,1982,1981,1980,1979,1978,1977,1976,1975,1974,1973,1972,1971,1970],"y":[6.7563405997071,7.79555325451991,8.64201135519056,8.10247264222744,6.51565823259701,6.33375464362749,10.2755242801352,11.930415133445,13.779401139351,16.068304247538,13.0709945040351,10.6292089762302,18.558449079164,13.9425933845845,13.2912961432126,12.7551339352434,10.3675299389301,8.46480888661974,8.4687647123447,8.57184195471215,9.92635800699168,6.50400119837688,6.63916910653856,8.7723428315509,10.3030939558398,9.36053394275299,9.01919368730684,8.05574794407208,8.52107280967508,7.65300590511661,10.6526486843235,10.5575638982083,8.35086550001435,8.25795346685897,7.21951897666772,9.64806394779036,7.98866753745988,7.43485625321937,6.61257531923003,6.98820859183282,15.331379739173,17.31912952925,9.52702139201712,11.3253181084379,10.0090575617805,9.82899260808236,12.0829990875764,5.4895378048187,3.78887061310129,4.01938792242889,4.42282044427999],"type":"scatter","mode":"markers","legendgroup":"Sub-Saharan Africa","showlegend":true,"key":["314","315","316","317","318","319","320","321","322","323","324","325","326","327","328","329","330","331","332","333","334","335","336","337","338","339","340","341","342","343","344","345","346","347","348","349","350","351","352","353","354","355","356","357","358","359","360","361","362","363","364"],"set":"SharedDatae687f454","name":"Sub-Saharan Africa","marker":{"color":"rgba(143,57,49,1)","line":{"color":"rgba(143,57,49,1)"}},"textfont":{"color":"rgba(143,57,49,1)"},"error_y":{"color":"rgba(143,57,49,1)"},"error_x":{"color":"rgba(143,57,49,1)"},"line":{"color":"rgba(143,57,49,1)"},"xaxis":"x","yaxis":"y","_isNestedKey":false,"frame":null}],"highlight":{"on":"plotly_click","persistent":false,"dynamic":false,"selectize":false,"opacityDim":0.2,"selected":{"opacity":1},"debounce":0,"ctGroups":["SharedDatae687f454"]},"shinyEvents":["plotly_hover","plotly_click","plotly_selected","plotly_relayout","plotly_brushed","plotly_brushing","plotly_clickannotation","plotly_doubleclick","plotly_deselect","plotly_afterplot","plotly_sunburstclick"],"base_url":"https://plot.ly"},"evals":[],"jsHooks":[]}</script> </div> </div> </div> Africa is a net exporter of natural resources --- class: inverse, center, middle ## Heckscher-Ohlin's theorem is as follows: > A country will export the good that requires a relatively more intensive use of the relatively abundant production factor, and will import the good that requires a relatively more intensive use of the relatively scarce production factor. --- .panelset[ .panel[.panel-name[Step 1] Let us first represent the domestic economy of the country in autarky. Let us imagine that this country can produce two goods `\(X\)` and `\(Y\)` at prices of `\(Px\)` and `\(Py\)` respectively. We can begin by representing two important parts: - the frontier of production possibilities; - the frontier of consumption possibilities, whose slope is simply the ratio of relative prices `\begin{equation*} \frac{Px}{Py} \end{equation*}` ] .panel[.panel-name[S 2] .pull-left[ At the optimum, the equilibrium point is represented by point E, which corresponds to the best allocation between factor resources and the technology available in the country to produce `\(X\)` and `\(Y\)`. Another important part is consumer choice. The indifference curve capturing the utility of domestic consumers to consume baskets of goods `\(X\)` and `\(Y\)` will be plotted. ] .pull-right[ <div class="figure"> <img src="./figures/fig10.1.png" alt="Équilibre de production en autarcie." width="100%" /> <p class="caption">Équilibre de production en autarcie.</p> </div> ] ] .panel[.panel-name[S 3] .pull-left[ The graph shows the combination of technology (production opportunity frontier), available choice (consumption opportunity frontier) and consumer choice (indifference curve). The optimum in autarky is obviously at point E; there is no other possibility unless the hypothesis of waste is introduced. ] .pull-right[ <div class="figure"> <img src="./figures/fig10.2.png" alt="Équilibre général en autarcie." width="100%" /> <p class="caption">Équilibre général en autarcie.</p> </div> ] ] .panel[.panel-name[S 4] What happens when a domestic economy opens up to international trade? To answer this question, we need to think about the variable that will be affected. - This variable is in fact the relative price ratio. With international trade, the good for which the economy is competitive will now be demanded by both the domestic and the foreign economy. - This will contribute to the increase in the price of that good. ] .panel[.panel-name[S 5] Let us assume that the domestic economy has a comparative advantage in the production of the `\(X\)` good. - The price of the product will increase to be higher in the domestic economy (damage to domestic customers), but lower than the price in the foreign country (super for foreign consumers). - This creates a new frontier of consumption possibilities represented by `\(\left( \frac{Px}{Py} \right)_2\)` . In the end, even domestic consumers gain. This is represented by the indifference curve `\(CI_2\)` which is higher than the initial indifference curve `\(CI_1\)`. This gain is captured by the trade gains triangle. ] .panel[.panel-name[S 6] <div class="figure"> <img src="./figures/fig10.3.png" alt="Gains du commerce pour le pays intérieur." width="80%" /> <p class="caption">Gains du commerce pour le pays intérieur.</p> </div> ] .panel[.panel-name[S 7] The following figure shows the graphs of the two countries: a) the foreign country and b) the domestic country. <div class="figure"> <img src="./figures/fig10.4.png" alt="Gains du commerce : a) pour le pays étranger; b) pour le pays intérieur." width="100%" /> <p class="caption">Gains du commerce : a) pour le pays étranger; b) pour le pays intérieur.</p> </div> ] .panel[.panel-name[S 8] <div class="figure"> <img src="./figures/fig10.5.png" alt="Gains pour des pays ayant des demandes identiques : a) autarcie; b) commerce." width="100%" /> <p class="caption">Gains pour des pays ayant des demandes identiques : a) autarcie; b) commerce.</p> </div> ] ] --- class: inverse, center, middle ## H-O Improvements (1/4): Samuelson --- .panelset[ .panel[.panel-name[Samuelson 1] **Factor Price Equalization: Samuelson's Theorem** Let country `\(I\)` be country `\(I\)` where the price of capital `\((r)\)` is relatively lower than the price of labor `\((w)\)`, and conversely in country `\(II\)`. > Both countries produce textiles and financial services. Textiles require more labour, and conversely financial services which require more capital. Country `\(I\)` will specialize a little more in the production of financial services and vice versa for country `\(II\)` which will produce textiles. The finished products will be sold in each country at prices `\(P_{textile}\)`, `\(P_{finance}\)`. `\begin{equation} \frac{W_{II}}{r_{II}} {<} \frac{W_{I}}{r_{I}} \end{equation}` With the opening of trade, relative prices in countries `\(I\)` and `\(II\)` are confronted with international relative prices: `\begin{equation} \frac{P_{finance}^I}{P_{textile}^I} {<} \frac{P_{finance}^{int}}{P_{textile}^{int}} {<} \frac{P_{finance}^{II}}{P_{textile}^{II}} \end{equation}` ] .panel[.panel-name[S2] The consequence of opening up to international trade will be greater specialization of country I in the production of the good for which it has a relatively more abundant resource. In this case, country I will produce more financial services and derive a little more from its capital factor. The consequence is an increase in the price of the capital factor and the reverse in country II, hence: `\begin{equation} \frac {\partial W_I}{\partial r_I} {<} 0 \text{ et } \frac {\partial W_{II}}{\partial r_{II}} {>} 0 \end{equation}` leading to: `\begin{equation} \frac{W_{II}}{r_{II}} = \frac{W_{int}}{r_{int}} = \frac{W_{I}}{r_{I}} \end{equation}` ] .panel[.panel-name[S3] .pull-left[ Samuelson's theorem: > At equilibrium, with the two countries facing the same relative product prices (price ratio), using the same technology, then the relative production costs will equalize. The only justification is that factor prices are equalized. ] .pull-right[ <div class="figure"> <img src="./figures/fig10.6.png" alt="Égalisation du prix des facteurs." width="100%" /> <p class="caption">Égalisation du prix des facteurs.</p> </div> ] ] ] --- class: inverse, center, middle ## H-O Improvements (2/4): Stolper-Samuelson --- ## Stolper-Samuleson The theorem emphasizes the income aspect and adds this dimension to the analysis of international trade. What is the effect of a more intensive use of the labor factor on the real wages of the two factors? The Stolper-Samuelson theorem is: > In a situation of full employment before and after the opening of international trade, the rise in the price of the abundant factor and the fall in the price of the scarce factor lead the owners of the abundant factor to see their income increase and the owners of the rare factor to see their income decrease. --- class: inverse, center, middle ## H-O Improvements (3/4): Linder --- ## Linder - Linder's theory - exchanges will appear for goods with similar demand functions; - international trade in manufactured goods will take place between countries with similar demand functions (per capita income). --- class: inverse, center, middle ## H-O Improvements (4/4): Leamer --- ## Leamer .panelset[ .panel[.panel-name[1] According to Leamer (2012), the Heckscher-Ohlin theorem raises a fundamental question: "What should governments do to capture the greatest gains from trade, also to ensure that the gains from trade are widely shared, and that the greatest great benefits accrue to the most deserving? Also according to Leamer (2012), the Heckscher-Ohlin model presented above has four main ideas on which to build public policy: 1. Trade barriers can increase the actual returns of rare factors in particular circumstances. 2. Investment in education and infrastructure can serve as the basis for product improvements that can turn low-wage developing countries into partners rather than competitors, enabling gains from trade in all factors of production . ] .panel[.panel-name[2] 3. Trade smooths the effects of capital accumulation and labor growth on the marginal products of capital and labor. 1. A country that produces a diverse mix of tradable goods can absorb immigrants with minimal impact on native wages. 2. A country that produces a diverse mix of tradable goods can absorb capital with minimal impact on the return to capital. Thus, the slowdown in growth that traditionally comes from a decline in the marginal productivity of capital is non-existent, or at least less severe for a small open economy. 4. Technological backwardness reduces overall GDP per worker, but in specific circumstances technological convergence has winners and losers. ] ] --- class: inverse, center, middle # 2. Competitive Advantage of Nations --- class: inverse, center, middle ## Wait! > What did Porter bring to this analysis? --- .panelset[ .panel[.panel-name[CAN 1] ## Porter’s Premises 1. Companies that have achieve international leadership employ strategies that differ in every respect, but the path is the fundamentally the same 2. Competitive advantage is achieved through acts of innovation (new technologies and new ways of doing things) * Innovation is mundane and incremental, depending more on an accumulation of small insights than major technological breakthrough 3. Competition is dynamic and evolving, and is central to innovation, so is adversity: *the fear of loss often proves more powerful than the hope of gain* **For Porter, a weak currency is not a source of competitive advantage** ] .panel[.panel-name[CAN 2] * Denmark: agromachinery, dairy, food additives, renewable energy * Germany: automobiles,chemicals,optical instruments,machine-tools * Italy: ceramic tiles, footwear * Japan: automobiles, shipbuilding, electronics, robotics, semiconductors * France: aerospace, ground transportation, agrobusiness, water treatment, waste management, tourism * South Korea: steel, shipbuilding, automobiles, semiconductors, electronics * Sweden: environmental control equipment, heavy trucks * United Kingdom: pharmaceuticals, insurance/financial services * United States: entertainment, aerospace, chemicals, pharmaceuticals, engineering/construction ] .panel[.panel-name[CAN 3] Defined a nation’s industry as internationally successful if it *“possessed competitive advantage relative to the best worldwide competitors”* Key findings * Differences in national values, culture, economic structures, institutions, and histories all contribute to competitive success * Nations succeed in particular industries because their home-environment is the most forward-looking dynamic and challenging ] ] --- .panelset[ .panel[.panel-name[Diamond 1] ### Porter’s Diamond of National Advantage <img src="./figures/fig3.png" width="1000px" style="display: block; margin: auto;" /> ] .panel[.panel-name[Diamond 2] ### Factor Conditions Availability of resources and skills necessary for competitive advantage (e.g. skilled labor or infrastructure): * Not inherited but created * Rate and efficiency with which a nation creates, upgrades, and deploys the factors is more important than volume * A factor must be highly specialized to an industry’s needs to support competitive advantage * Highly specialized factors come from world-class institutes that create and then upgrade them * Selective disadvantages can lead to innovation and upgrade (e.g. high land cost, labor shortage, or lack of local raw material) * Signal companies and companies innovate in advance of rivals * Need favorable conditions in others aspects of the diamond * Need company commitment ] .panel[.panel-name[Diamond 3] ### Demand Conditions Home market – information that shapes the opportunities that companies perceive and the directions in which they deploy their resources and skills: * Gives companies clear and early picture of emerging buyer needs * Demanding buyers * Character more important than size: * Market segment larger or more visible than in foreign countries * Buyers are more sophisticated * Buyers’ needs anticipate or even shape those of other nations ] .panel[.panel-name[Diamond 4] ### Related and Supporting Industries International competitiveness of supplier industries & other related industries * Internationally competitive industries can provide competitive production methods and trigger innovation and upgrading ] .panel[.panel-name[Diamond 5] ### Firm Strategy, Structure, & Rivalry Conditions governing how companies are created, organized, and managed, and the nature of domestic rivalry * Domestic rivalry stimulate competition, creating pressure on companies to innovate and improve ] .panel[.panel-name[Diamond 6] ### Role of Government * Creating the conditions that will permit companies to strive * Taxation/credits for innovation (not subsidies) * Regulations * Long-term focus ] ] --- class: inverse, center, middle ## Wait! > The role of luck? --- ## Porter’s 8 Commandments for Nations 1. Focus on specialized factor creation 2. Avoid intervening in factor and currency markets 3. Enforce strict product, safety, and environmental standards 4. Sharply limit direct cooperation among industry rivals 5. Promote goals that lead to sustained investment 6. Deregulate competition 7. Enforce strong domestic antitrust policies 8. Reject managed trade --- ## The Company Agenda 1. Create pressures for innovation 2. Seek out the most capable competitors as motivators 3. Establish early-warning systems 4. Improve the national diamond 5. Welcome domestic rivalry 6. Globalize to tap selective advantages in other nations 7. Use alliances only selectively 8. Locate the home base to support competitive advantage --- class: inverse, center, middle # Conclusion --- .panelset[ .panel[.panel-name[1] In short: > Globalization = goods + services + people + knowledge - Samuelson - Heckscher-Ohlin - Stolper-Samuelson - Linder's theory - Leamer ] .panel[.panel-name[2] ## Factors driving comparative advantage * Technological differences * Differences in the availability of factors of production (labour or finance) (also called factor endowment) In summary: countries will export products that use their abundant and cheap factors of production and import products that use the countries scarce factors Trade is a positive-sum game (in theory) and is the result of differences in endowments and technologies (in theory again) In practice, there are transition costs to bear. ] ]