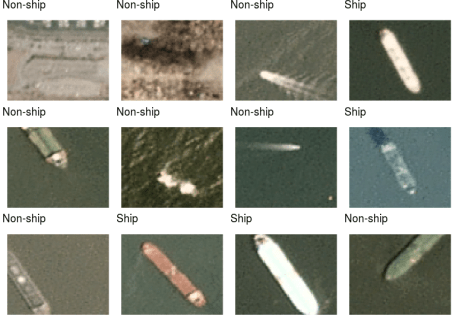

class: center, middle, inverse, title-slide # 2. International Industrial Comparative Analysis and MNEs’ Global Strategies ### Thierry Warin, PhD, HEC Montreal, Harvard University & Cirano --- ## Study Case (Mandatory Reading): - Volvo Trucks (A): Penetrating the U.S. Market - A cross-industry analysis of intra-industry trade measurement thresholds: Canada and the United States, 1988–1999. Andresen, Martin A. Empirical Economics. June 2010. Recommended readings: - Are Losers Picked? An Empirical Analysis of Capacity Divestment and Production Reallocation in the Japanese Cement Industry. Nishiwaki, Masato; Kwon, Hyoeg Ug. Journal of Industrial Economics. June 2013 - What determines productivity performance of telecommunications services industry? A cross-country analysis. Ng, Eric C. Y. Applied Economics. 2012. - Has Europe Been Catching Up? An Industry Level Analysis of Venture Capital Success over 1985-2009. Kräussl, Roman; Krause, Stefan. European Financial Management. Jan 2014. --- ## Contents 1. Approaches to evaluate an industry 2. International industrial comparisons (www.mondo.international: key factors of industries at the international level), industrial differences 3. Degree of rivalry and competitiveness in an industry, performance of the industry **Keywords:** Competitiveness and rivalry (oligopolies) --- ## Introduction: history and context ### Alfred Marshall: Economics of Industry (1879) - Marshall criticizes the coherence between **pure and perfect competition** (PPC) and the existence of **increasing returns** (and decreasing average cost curves) ### Robinson (1934) and Chamberlin (1933) - They propose the model of **monopolistic competition** from which the hypothesis of **product homogeneity** is abandoned in favor of **product differentiation**. --- ## Introduction: history and context ### Harvard School - Mason (1939) and Bain (1959): the SCP paradigm (Structure-Conduct-Performance) - Carlton and Perloff (1998): a new industrial economy --- ## 1. Approaches to evaluate the industry | Market Structure (S) | Market Dynamics (D) (Conduct) | Market Context (C) | |---------------------------------------------------------------------------------------------------|:---------------------------------------------------------------------------------------------------------------------------------------:|----------------------------------------------------------------------------------------:| | Nature of the firm / Technology and production process / Competition and monopoly / Oligopolies | Limit pricing and predatory pricing / Price discrimination / Product differentiation / Innovation, standards, techonological lock-ins | Comparative advantages / International trade / Industrial policies / cluster policies | --- ## 1. Approaches to evaluate the industry Question: You have just spent your first week searching for data on an industry of your choice. What reflections have you made so far? --- ## 1. Approaches to evaluate the industry For instance, I would start with: - a measure of **political risks** - **business risks** (including reputational risk linked to social netoworks), - **operational risks** in the countries where my firm is. > Go the academic literature on ECONBIZ (menu Resources>Search articles) --- ## 1. Approaches to evaluate the industry > What is a firm? --- ## 1. Approaches to evaluate the industry ### The firm and the market - Robertson (1928) : "Islands of conscious power in an ocean of inconscious cooperation" - Coase (1937): theory of transaction costs - Williamson (1985) : forms of hybrid organization between market and hierarchy --- ## 1. Approaches to evaluate the industry ### Firm and business management - Robinson (1934) and Kaldor (1934) : coordination is the essential element of management - Richardson (1964) : the management capacities drive the growth of the firm - Porter (1987) : Porter's 5 forces (at the level of an industry) --- ## 1. Approaches to evaluate the industry <img src="session2_resources/porter5Forces.png" width="550px" style="display: block; margin: auto;" /> --- ## 1. Approaches to evaluate the industry - The industry - or the industrial sector - is a collection of firms that often interact in competition and sometimes (more and more often) in partnerships. --- ## 1. Approaches to evaluate the industry | Competition by Quantitities within an Oligopoly | Competition by prices within an Oligipoly | |----------------------------------------------------|:-------------------------------------------------------------------------------:| | Symmetrical: Cournot / Asymmetrical: Stackelberg | Without capacity constraints: Bertrand / With capacity constraints: Edgeworth | --- ## 1. Approaches to evaluate the industry According to Porter: "Competitiveness depends on the long-run productivity of a location as a place to do business. It should be useful to people." --- ## 2. International industrial comparisons <img src="session2_resources/secteurs.png" width="700px" style="display: block; margin: auto;" /> <http://mondointl.cirano.qc.ca/data-by-sector/> --- ## 2. International industrial comparisons <img src="session2_resources/secteurs.png" width="700px" style="display: block; margin: auto;" /> <http://mondointl.cirano.qc.ca/industry-analysis/> --- ## 2. International industrial comparisons <img src="session2_resources/unido.png" width="900px" style="display: block; margin: auto;" /> <http://mondointl.cirano.qc.ca/industrial-dashboards-unido/> --- ## 2. International industrial comparisons <img src="session2_resources/industriesKensho.png" width="800px" style="display: block; margin: auto;" /> <http://kenshoindices.com/> --- ## 2. International industrial comparisons <img src="session2_resources/clustersMondo.png" width="750px" style="display: block; margin: auto;" /> <http://mondointl.cirano.qc.ca/international-cluster-portal/> --- ## 3. Degree of rivalry and competitiveness in an industry - Porter, M. (1998) Competitive strategy : Techniques for analyzing industries and competitor, New York : Free Press, Chapter 1 « The structural analysis of industries » "The essence of formulating competitive strategy is relating a company to its environment. Although the relevant environment is very broad, encompassing social as well as economic forces, the key aspect of the firm's environment is the industry or industries in which it competes." --- ## 3. Degree of rivalry and competitiveness in an industry ### Barriers to entry According to Demsetz (1982), there are 3 types of barriers to entry: - **natural** barriers (economies of scale) - **legal** barriers (intellectual properties, etc.) - **strategic** barriers (reputation, etc.) --- ## 3. Degree of rivalry and competitiveness in an industry ### Product differentiation strategies: Hotelling (1929) <img src="session2_resources/hotelling.png" width="600px" style="display: block; margin: auto;" /> --- ## 3. Degree of rivalry and competitiveness in an industry ### Product differentiation strategies: Salop (1979) <img src="session2_resources/salop.png" width="550px" style="display: block; margin: auto;" /> --- ## 3. Degree of rivalry and competitiveness in an industry ### Price strategies (Sweezy, 1939; Stigler, 1947) - **Discrimination** strategies (Enke, 1964) - **Predatory** price strategies (Salop, 1979) - **Limit pricing** strategies (Smiley, 1988; Modigliani, 1958; Bain, 1956; Sylos Labini, 1962) --- ## Conclusion - From the industry level to the industrial cluster, from theory to practice - The **difficulty to define** an industrial sector - The need of a rigorous process - **Competitiveness and Rivalry** (in an oligopolistic context) --- ## Conclusion [The key to growth](https://www.ted.com/talks/erik_brynjolfsson_the_key_to_growth_race_em_with_em_the_machines) --- ## Conclusion  --- ## Conclusion [Machine Learning for International Trade](https://www.r-bloggers.com/a-guide-to-gpu-accelerated-ship-recognition-in-satellite-imagery-using-keras-and-r-part-i/)